I often see my siblings and cousins splurge on expensive tech gadgets – the latest iPhone/Apple Watch/Airpods/branded shoes – you name it. And I often think, true, some of these items are sometimes necessary for your productivity but often, they are a big waste of money, money that could be put to better use. For me, that has always come in the form of investing. Years ago, when I was around 16, I used my dad’s legal identity to buy cryptocurrencies from international platforms and learned quite a lot about that niche. Yet, later on, I shifted my focus on the stock market because of my disillusionment with where the crypto ecosystem was headed. So how did I start investing in stocks, how can you do so too?

Let’s start.

Firstly, there are 2 main ways to invest in stocks for the average retail investor:

- Buy shares of individual stocks through a stock brokerage – minimum investment varies depending on the brokerage. I use KTrade which allowed me to invest from a minimum of Rs.5000, others can also have higher requirements from Rs.25000 – 1 Lakh. However, this minimum limit is only for the first time. Subsequent investments can be made of amounts as low as Rs.1000.

- Buy units of a mutual fund that invests in a pool of stocks, thereby offering you diversification and serving as a means of indirect investment. These too have minimum investments, for Meezan, it was Rs.5000 + an Rs.1000 account opening fee.

Both of these approaches have their pros and cons and so we will be looking at both starting from individual stocks.

Individual Stocks

Firstly, we need to create an account with a stock brokerage firm. You can find a list of these on PSX’s website along with their contact details. What we want is a brokerage with a good reputation, minimum investment requirements, and an online trading platform so it is easy for you to invest from the comfort of your home. As mentioned above, I chose KTrade but you can also do your research(FB stock investment groups are a good place) and try others.

Once you have created an account by going through the formalities of submitting documents, etc; you need to select the stocks that you want to buy. For long-term investment purposes, it is important to analyze these on a fundamental basis with the view of being content if you had to keep your investment for 5 to 10 years. This of course is not something that can be learned overnight and so it is recommended that you spend some time learning this art. I personally read a few books and then scoured the internet improving my concepts over time.

Market Research

Now if I want to evaluate an individual stock, I would do the following:

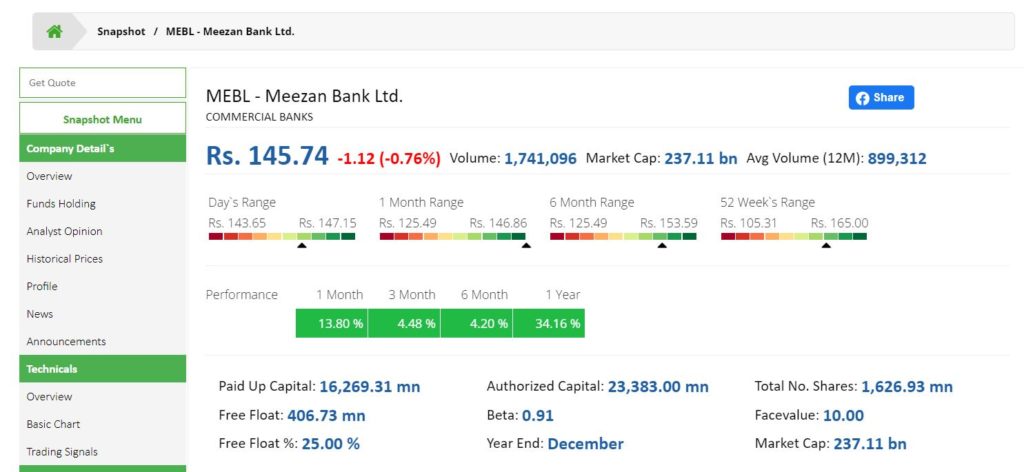

- Check an overview of the stock on its listing page on a research tool such as SCSTrade’s Portal or PSX’s website to evaluate different ratios and values. There are so many to cover in one post but different variables work together to help you eventually decide. For example, as shown in the picture below, I will look at the price range of the stock, its profitability, its PE-to-growth ratio, etc to make a decision from a simple one-page report from SCSTrade.

- Evaluate the competitive position of the company. For example, I invested in Ghani Glass Limited because I see it as one of the market leaders in the Pakistani glass market and so this will help it maintain profitability in the long run. You could also learn more about what makes the company different for it to last, is it just another normal textile company or is it something special?

- Read the company’s financial statements to verify the data found in step 1 or to learn in more detail about the company’s operations.

- Check the price movements of the stock according to your time horizon. For example, let’s say, I want to invest for a period of 1 year in Meezan Bank and the maximum price range as shown is Rs.165 in the past 52 weeks. If I invested at Rs.160 per share, I cannot expect to gain much from my investment in this period since the past upper cap doesn’t indicate that the price will rise much higher but on the other hand, if I purchase it for Rs.105 per share, I can reasonably expect a profit knowing that yes the share price will go up whenever the market or stock recovers to a good price around Rs. 140-160.

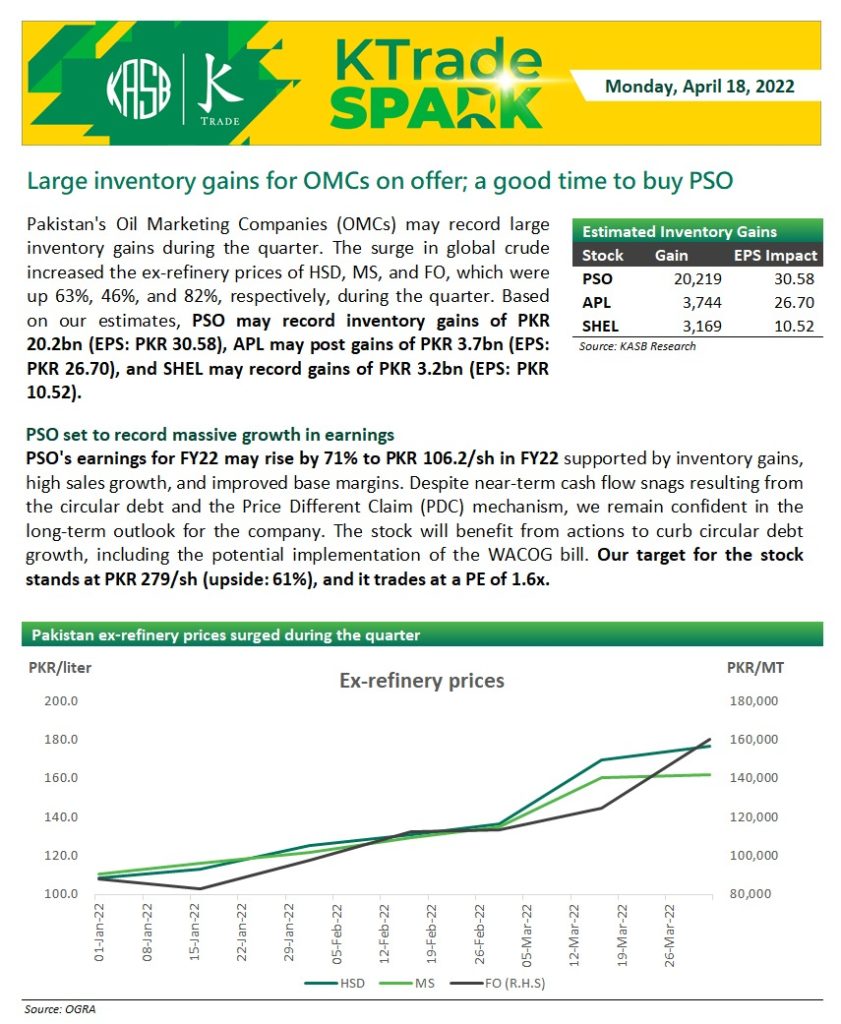

- Use market research reports provided by stock brokerages and general news platforms. KTrade provides me these on a daily basis but these would be more useful for day traders rather than long-term investors:

An example of a market research report by KTrade

An example of a market research report by KTrade

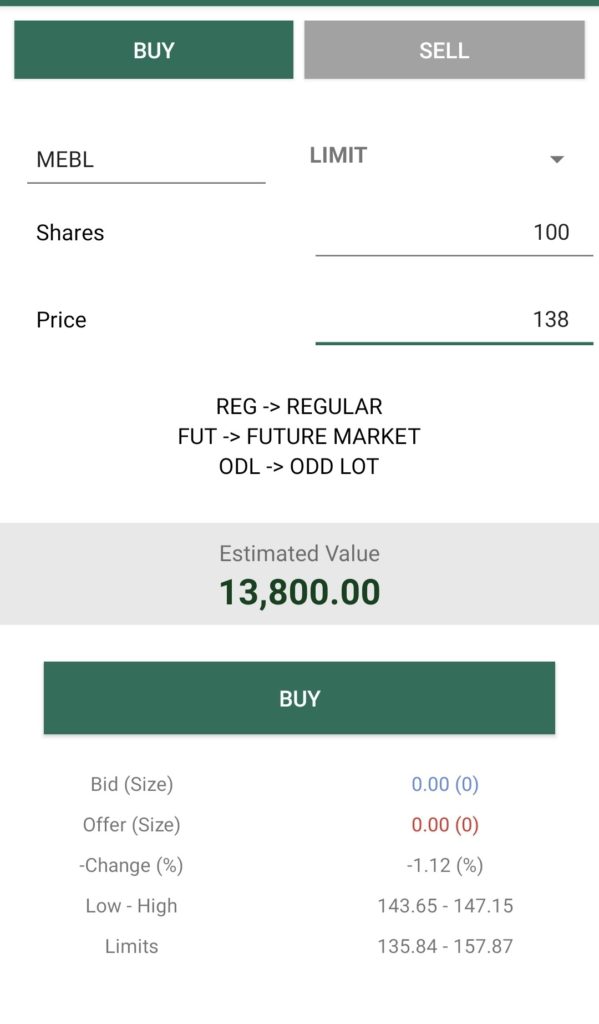

After selecting a stock, then you can invest through the brokerage’s online platform or by any other conventional means provided. So this method is pretty simple – you create an account, select a stock, and then make your purchase. The purchase can be made using different types of orders including Market orders, limit orders, etc – you should learn about these but a market order usually suffices.

It is important to note that you can only make investments during normal stock market hours and so it is important to keep track of these if you wish to regularly trade or just execute a planned transaction. Your broker can help you with this.

The tricky part of course with making individual stock investments lies in the risk inherent with this approach. If your analysis proves to be wrong and the company performs poorly, you could lose a substantial chunk of your investment since it was vested in one company. Ofcourse, people invest in different individual securities at the same time to hedge this risk but you can only purchase so many securities.

Mutual Funds

Secondly, when you invest in units of a mutual fund, you basically receive your returns according to the performance of the fund itself. This performance can vary depending on the fund type and purpose. This is because a range of mutual funds exist differing in terms of the investments they make – some invest primarily in gold, some in equity securities, some in fixed income securities such as bonds, etc. So if you wish to invest in the stock market through this method, you will buy units of an equity-based mutual fund whose majority investments are in the stock market.

Now, how does the process actually work?

It’s pretty simple. In Pakistan, we have hundreds of mutual funds that are operated by either standalone investment management companies or by banks such as Meezan, Alfalah, JS, HBL, etc. So firstly, you will choose the mutual fund company you wish to go with. I personally chose Al Meezan Investment Management Limited because for me it was important that all my investments were Shariah Compliant and so they stand out in this category.

Secondly, you need to provide some information to the mutual fund company depending on the account type you are opening. For some accounts with an upper cap on the total investment, the requirements are less stringent whereas, for others, more documents are needed as shown in the picture below from Al Meezan’s website:

This is much like how JazzCash or EasyPaisa allow anyone to open accounts but need further documents if you want to extend your account transaction and receiving limits. Yet, the documents required are all ordinary, nothing special that you would have to go through bureaucratic hurdles to obtain.

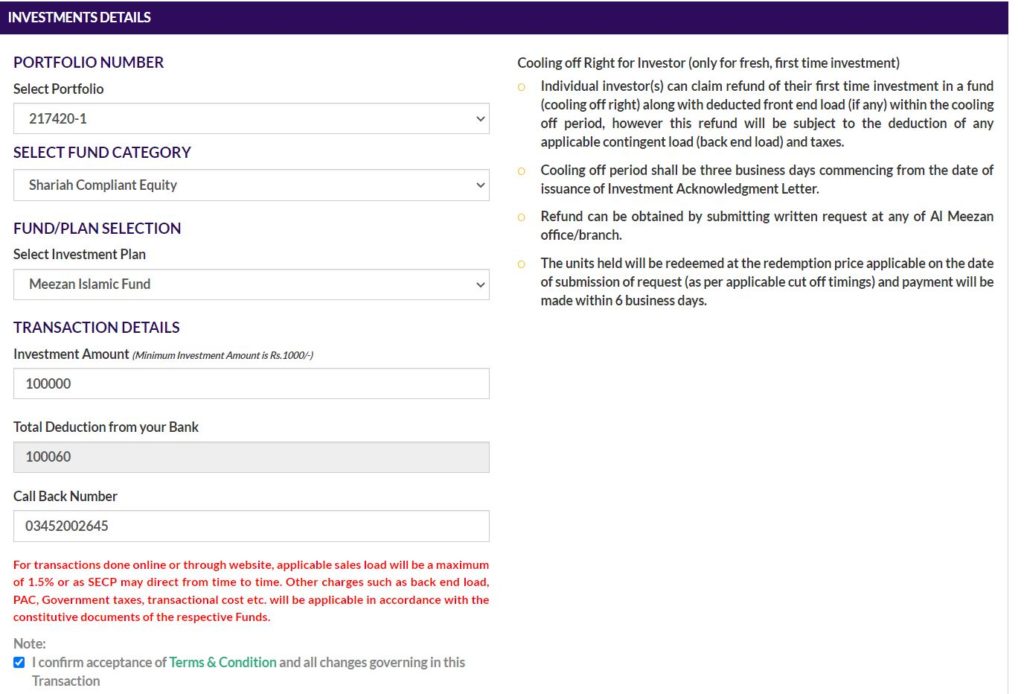

Once done, you are now ready to invest through cheque/online transfer/other means available which may depend on your account type and other specific details. Since I have a Meezan bank account as well, I am able to invest simply through online means:

Now, to start, we have to choose a mutual fund to invest in.

Every investment management company has a wide choice of funds you could choose from but we have to make this decision by evaluating certain attributes. This includes the average returns of the fund over the past 1 month to 10 years and how it has performed compared to the market benchmark(usually the KSE-100). For example, if I want to invest for the long term with a time horizon of 5-10 years, I want to make sure that the return during this period can outpace inflation at least because there is no point in getting an 8% return when the inflation rate is at 10% because then you are actually losing money. This is a problem with all of the funds that aim to provide you an income on a monthly basis, they do offer returns but those returns do not earn you any “real money”, you are only reducing the rate at which you lose money.

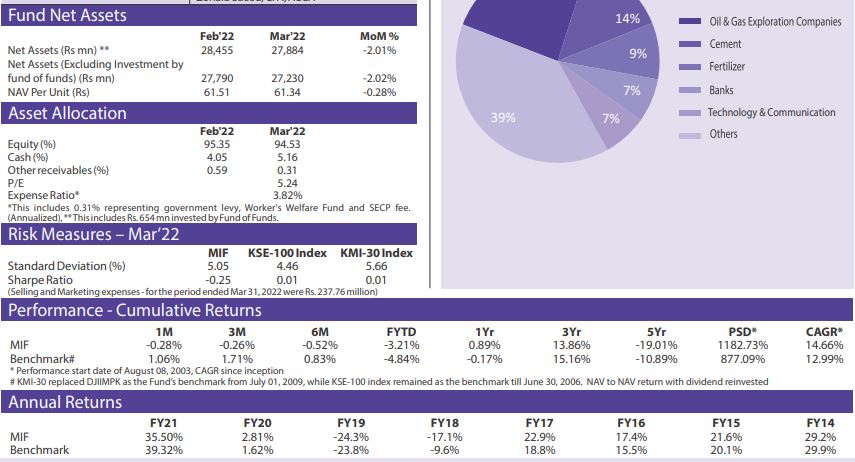

To evaluate the above information, we will look at something known as a fund manager report. This report is issued by every mutual fund detailing the investments it has made, its performance, any management commentary, and other crucial insights such as the standard deviation/beta figures. For this article, we will be looking at Meezan’s fund manager reports for March 2022:

Types of Mutual Funds

Firstly, we have a list of the different mutual funds they offer sorted by the following:

- Equity funds focus on investing in stocks.

- Index tracking funds basically invest in the securities that make up a particular market index like the KSE-100. This is a popular approach for investors who just want to remain invested in the market without any changes in their portfolio occurring over time. U.S investors may relate to this considering the popularity of tracking the S&P 500 index as also recommended by Warren Buffet on several occasions.

- Commodity funds invest in assets like gold which happens to be the only such fund here.

- Money market funds invest in liquid securities such as cash, government bonds, commercial paper, etc.

- Fund of Funds is basically “a mutual fund that invests in a range of other Mutual funds” and could be for any asset class – equities, income securities, etc.

- Income funds are to give investors a steady amount of income while preventing their capital from any losses.

Now, from amongst these, I have invested in Meezan Islamic Fund – equity-based and Meezan Gold Fund – commodity-based. Everyone will have their own reasons as to why they go with a particular fund but here are my reasons with a look at its report:

A snippet of a fund manager report showing different performance measures

A snippet of a fund manager report showing different performance measures

I do not need any income on a weekly or monthly basis so my sole focus is on multiplying my initial investment. With this fund focused on equities, I want to remain invested for 5 to 10 years and realize capital gains that I can cash out on. If you see the PSD figure given in the 2nd last row, it shows us that the fund has earned a 1182.73% return in total since it started on August 8, 2003. If I can earn such a phenomenal return on my investment over 10 years, that is a lot and it accomplishes my purpose. Now I do know that in the short term, I may very well make losses. For example, if you invested in 2018, you would make consecutive losses for both 2018 and 2019 with a meager 2.81% return in 2020 which doesn’t even outpace inflation. But the real goal lies in long-term investing and so short-term losses really don’t bother me.

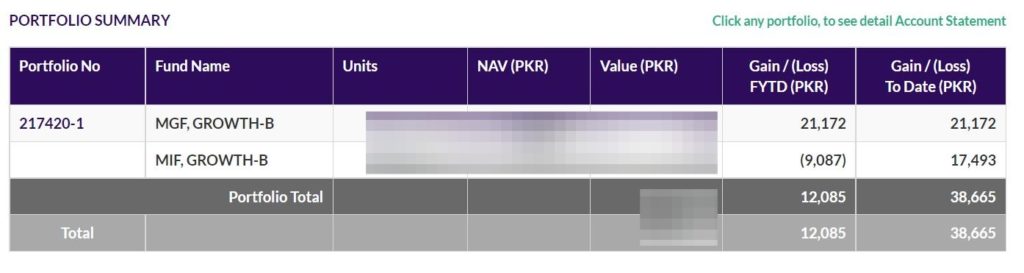

A summary of my portfolio showing a loss in Meezan Islamic Fund for this year – doesn’t bother me

A summary of my portfolio showing a loss in Meezan Islamic Fund for this year – doesn’t bother me

Because think about it this way – when you invest in a small business or start a new business, do you expect it to become a cash cow straight away? No, you realise that it takes 5 to 10 years for the business to become strongly profitable and a force to be reckoned with. Similarly, when we are investing in stocks, we are investing in real businesses that take time for real growth.

Secondly, for the Gold Fund, I invested in it to diversify my risk to a certain extent away from the stock market and to also benefit from the price appreciation in Gold. This is because the price of Gold usually increases over the long term and so it is a very safe investment for parking at least 5-10% of your total portfolio value.

Based on the above analysis, once you have decided which fund is right for you, you can simply make a payment, and voila, you are now invested in the stock market!

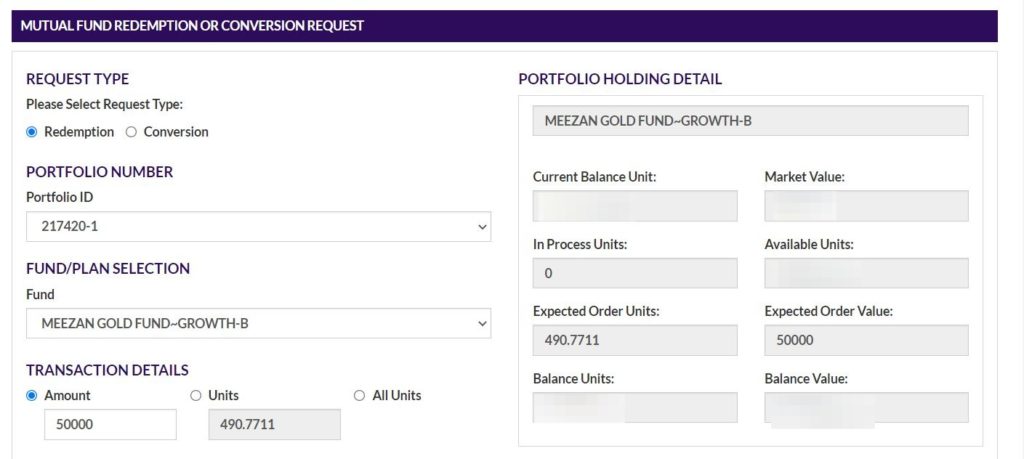

From the above 2 methods, you can redeem your investment amount at any time which may take 2-3 business days.

A redemption request online form for mutual fund unit

A redemption request online form for mutual fund unit

You should of course not invest any cash you might need for an emergency since selling your investment at the wrong time can make you sell at a loss. Therefore, it is always beneficial for you to invest any spare cash in the stock market or other mutual funds but keep a buffer amount as liquid cash in the bank as well.

Conclusion

To conclude, these are the 2 main ways you can invest in stocks in the Pakistani Stock Market. I would always recommend beginners with little knowledge to start with mutual funds and then slowly start investing in individual stocks. For the future, I would advise you to keep investing a small amount whenever you have the liberty to do so – perhaps a few thousand rupees now and then since it is always better than spending it on the latest gadget or other materialistic purchase. You may very well end up building your future in this way.