Every investment that I make, I make sure that I check if it is Halal or “Shariah-Compliant” – in line with Islamic law. Cryptocurrencies, bonds, derivatives, stock, and any other investment you can think of would have a ruling pertaining to it derived by scholars based on underlying Islamic principles. Keeping this in mind, how do we know if a stock or a mutual fund that we are investing in is Shariah Compliant?

Let’s start with stocks. For stocks, we have 6 main rules that have been followed by Islamic Financial Institutions(IFIs) internationally albeit, with variations. These rules are available on the websites of these IFIs as well in addition to a list of the stocks that they consider Shariah Compliant. For example, you can find a list of Meezan’s decisions on different stocks on their website and the methodology used to screen them as well.

However, even if such information is readily available, it is important for you to understand how to screen a stock yourself because sooner or later, you will find a company not analyzed by any of these IFIs for its Shariah status or you may not be able to understand how a particular stock is being declared as Shariah Compliant when clearly one of the criteria mentioned below is not being met. So to start with, here are the 6 main principles:

1. Stock should belong to a company that is operating in a Halal industry.

This one’s pretty simple and so any company whose primary activity is Islamically impermissible cannot be considered Shariah Compliant. Examples of such activities would include interest-based banking & insurance, entertainment businesses involving the making of dramas and films(HUM Network’s stock as an example), tobacco companies, defense stocks, gambling & adult entertainment companies(found in markets abroad), and anything else that is clearly impermissible.

Now, you may ask, why would you include tobacco companies considering that many scholars consider it as “Makrooh” but not Haram exactly. The answer is, true, many scholars would consider it permissible but a large percentage also deem it impermissible – couple this with the fact that it is an inherently unethical activity, and most Shariah boards would not deem a Tobacco stock to be Halal because of the company’s impact on society through its core business activity.

Secondly, why defense stocks? Now, this is a much more subjective classification and I have good reason to say that such businesses may in the majority of cases not be permissible. This is because to see if a defense sector company that manufactures weapons for the army is ethical, you need to ask, which country’s army does it supply those weapons to? If you take a U.S based company like Lockheed Martin, it is the U.S Army and therefore it is no secret that these weapons have been and will continue to be used to fund the invasion of foreign states including many Muslim ones. A company that benefits from such destruction can never be ethical nor Halal. If you take any other country’s defense stocks, for example, India, the argument remains the same, almost every country’s army is engaged in human rights violations at some junction and so the wise choice would be to steer clear even if the degree of involvement in such affairs may vary. This is in line with the Prophetic tradition which states:

That which is lawful is clear and that which is unlawful is clear and between the two of them are doubtful [or ambiguous] matters about which not many people are knowledgeable. Thus, he who avoids these doubtful matters certainly clears himself in regard to his religion and his honor. But he who falls into the doubtful matters falls into that which is unlawful like the shepherd who pastures around a sanctuary, all but grazing therein. (Al-Bukhari & Muslim)

2. Interest-bearing debt/total assets ratio < 37%

This rule’s percentage and principle again vary according to the Islamic boards or authorities of different countries but in Pakistan, since Meezan Bank uses 37%, we will be using it as the basis of our calculations. For example, the Dow Jones Islamic Index has placed another set of rules as follows:

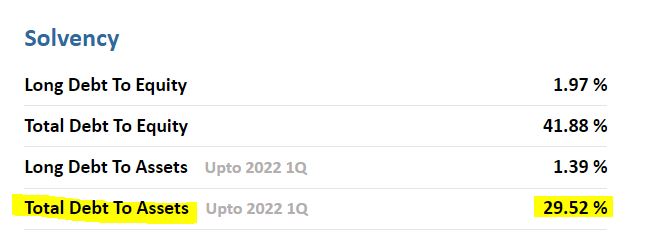

It is important to know that Islamic debt without interest would not be included in this calculation(at least the ones we are doing rationally) so Sukuks(Islamic bonds) would not count. On the other hand, since instruments like Preferred Stock carry a component of debt, they too would be included in this calculation. Now, to find this ratio, the good part is that most stock analysis platforms readily give you this information. For example, here’s a snapshot of Systems Ltd from SCSTrade:

In this case, the total debt to assets ratio is less than 37% and so we know that it passes this rule check. However, things are always not so simple, sometimes the debt to assets ratio may exceed 37% but then you need to find out if all of this debt is interest-bearing or not to avoid making a wrong classification. A great example I personally encountered is Pakistan State Oil(PSO). On Meezan’s website, they show PSO as being Shariah Compliant:

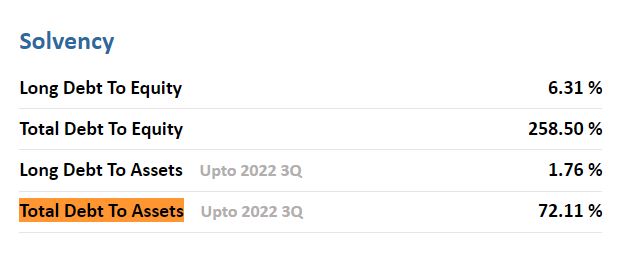

However, when we visit SCSTrade and check the Total Debt to Assets ratio, it is not below 37%:

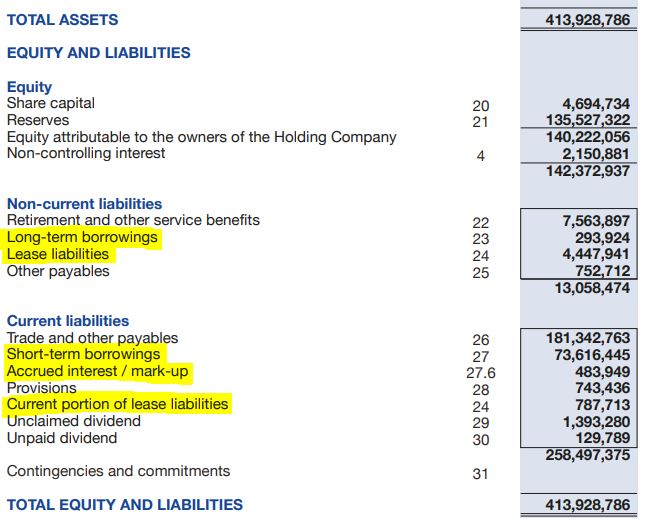

Now, the problem here is that the total debt when calculated by automated software adds up all of the liabilities, both long-term and short-term regardless of their interest-free nature. However, when calculating interest-bearing debt, we will not consider Accounts Payables or similar liabilities without any interest component. Therefore, to verify that Meezan has not made an error, we will analyze PSO’s balance sheet for 2021 as the Shariah Compliance rating is as of June 2021.

As shown above, the total interest-bearing debt can be calculated by adding the highlighted rows, this amounts to Rs.79,629,972,000(the balance sheet amounts are in 000s). If we divide this by the total assets figure of Rs.413,928,786,000, we get 19.24%. Therefore, this is the correct number as opposed to what we would have believed at first sight. If you need any further details for each of these line items, you can always find them in the notes to the financial statements with the exact note number written to the right.

Is there a way to see what calculations Meezan did? Yes, they have also published a detailed document stating the breakdown of each of these 5 Shariah Compliance rules, a snapshot of which below shows that for PSO, they calculated the interest-bearing debt to total assets ratios as 18.25% in the very first column:

![]()

But why 37% or for the matter any such number? The rationale is explained by Dr.Muhammad Imran Ashraf Usmani in his book “Meezan Bank’s Guide to Islamic Banking” where he states:

The basis of 30% is that the 30% is less than one third of the total assets of the company and one third has been considered abundant by the following Hadith of the Prophet PBUH: “One third is big or abundant”(Tirmidhi). Hence, whatever is less than one third would be insignificant.

Keeping this in mind, I’m not sure why 33% was extended to 37% by Meezan Bank but it does offer insight into the rationale above. Plus, since PSO is under 20%, it has a wide margin of safety regardless and so we should not worry.

3. Haram or non-Shariah compliant investments of the business should not be more than 33% of the total assets.

Again, there are variations in this principle too, as an example, Dr.Imran Usmani states that they should not be more than 30% of the total market capitalization. I feel total assets are a more appropriate indicator here since market capitalization can fluctuate with the share prices without any impact on the underlying fundamentals of the business. The rationale here for the 30 or 33% is again explained by the Prophetic tradition quoted above.

Here, non-compliant investments could involve the company purchasing bonds or other forms of marketable securities such as shares in companies that are not Shariah-compliant. These too can be manually assessed by analyzing the balance sheet and notes to the financial statements which detail the company’s investments. For PSO as an example, it is 0%.

But on the other hand, consider a company like The Resources Group(TRG) – it is a holding company for managing investments in its subsidiaries which are usually tech companies, Afiniti & IBEX as a couple of examples. Yet, for some reason, these investments are considered to be non-compliant(the Debt to Asset Ratio, etc may be off) and it has a ratio of 98.79% for this principle here making the company Haram to invest in. This is how even seemingly compliant companies can be in reality non-compliant making these calculations very important.

4. The haram or non-compliant income of the business should not be more than 5% of the total revenue of the company.

Why 5%? Dr.Imran Usmani again very concisely explains this in this book:

There is no specific basis derived from the Holy Quran or Sunnah for the 5% rule of non-halal(impermissible) income. However, this is only the collective outcome (conensus) or Ijtihad of contemporary Shariah scholars.

…. In partnership, all the policy decisions are taken through the consensus of all partners, and each one of them has a veto power with regard to the policy of the business. Therefore, all the actions of a partnership are rightfully attributed to each partner. Conversely, the

majority takes the policy decisions in a joint stock company. Being composed of a large number of shareholders, a company cannot give a veto power to each shareholder. The opinions of individual shareholders can be overruled by a majority decision. Therefore, each and every action taken by the company cannot be attributed to every shareholder in his individual capacity. If a shareholder raises an objection against a particular transaction in an Annual General Meeting, but his objection is overruled by the majority, it will not be fair to conclude that he has given his consent to that transaction in his individual capacity, especially when he intends to refrain from the income resulting from that transaction.Therefore, if a, company is engaged in a Halal (permissible) business, but also keeps its surplus money in an interest-bearing account, wherefrom a small incidental income of interest is received, it does not render all the business of the company unlawful. Now if a person acquires the shares of such a company with a clear intention that he will oppose this incidental transaction also, and will not use that proportion of the dividend his own benefit, then it cannot be said that he has approved the transaction of interest and hence that transaction should not be attributed to him.

This aptly explains it. Therefore, the non-compliant income will be purified by donating a percentage of the dividends received. This percentage will vary based on different companies, for Pakistan, we do have a list available by Meezan as shown below but you may have to do some working for another country or a new stock. This could be done by breaking down the source of revenue as given in the financial statements and then dividing the non-compliant revenue with the total revenue to obtain a percentage.

5. Ratio of Illiquid assets to total assets >= 25%

The reason for this is that if all of the company’s assets are liquid, then this would be as if one is trading money for money. Let’s say a business has Rs.1 crore in cash as its total assets and nothing else. To buy the company for Rs.1.5 crore would be paying an excessive amount of money for the Rs.1 crore of cash and therefore would be interest/Riba. In light of this, scholars have determined various proportions for this rule according to different jurisprudential schools. For example, Dr.Imran Usmani mentions that in the Hanafi school, an asset can be negotiable if it is simply composed of a combination of liquid and illiquid assets based on the condition that the illiquid part is significant(25% in this case) and “the price of the combination should be more than the value of the liquid amount contained therein”.

Now, logically, some companies could not meet this requirement due to their nature, tech companies for example. For them, relaxation could be made in regards to this ratio. Using Meezan’s classification data, Avanceon, a tech company has an illiquid to total assets ratio of 17.28% yet it still has been declared compliant for this very reason.

6. Share Price > Net Liquid Assets/Share

For example, if the liquid assets/share are of Rs.50 and the illiquid assets /share are of Rs.25, the shares for such a company cannot be traded at a value below or of Rs.50 since that would be paying less than the “money amount” within the company. In this case, for example, if the share is trading for Rs.80, this would mean that the shareholder is paying Rs.50 for the liquid assets(same amount for money) and Rs.30 for the Rs.25 worth of illiquid assets. Very less companies though breach this rule since their stock would have to be terribly depressed or they would have to be in a terrible financial position for their share price to be less than what the liquid assets alone could cover.

To conclude, these are 6 factors that we use when evaluating any stock with their respective proportions varying according to the country and school of jurisprudence applied. I would advise you to seek companies that offer a suitable margin of safety against these criteria. For example, the total debt/assets if at 20% would have to get the company to add significant debt for it to breach the 33% threshold. On the other hand, if a company has a 32% total debt/assets ratio, it may be compliant now but if it takes on more debt in the future, it may become non-compliant and you may have to exit your position in haste selling the stock.

Mutual Funds

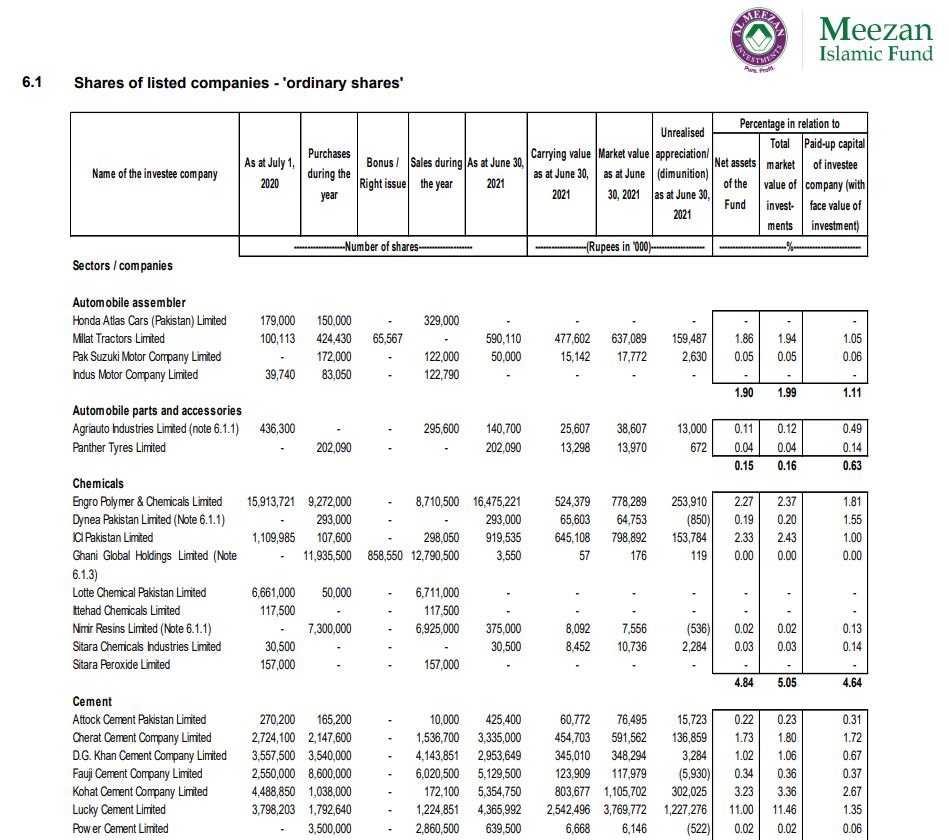

If you wish to evaluate Mutual Funds, it is as simple as seeking those funds which have a “Shariah Compliance” aim in the fund’s core policies. For example, Meezan Islamic Fund by law cannot invest in non-compliant equity securities and therefore I’m pretty sure that my money is being invested in Halal businesses. For confirmation, I can always open up the fund’s financial statements from their website and analyze their various holdings as well to see if any non-Shariah compliant companies are included:

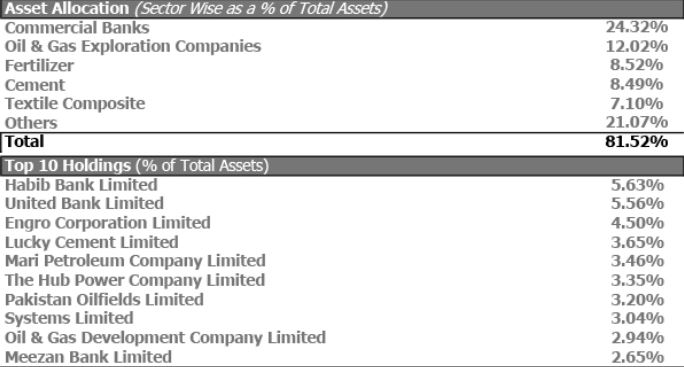

On the other hand, I would not expect Bank Alfalah’s equity funds to be fully Shariah-compliant as they have made no such commitment to their unit-holders nor is this a policy guideline that they have to follow. This of course holds true for its conventional funds, you can still check out its Islamic Funds which make the Shariah-compliance point a priority. To prove my point, take the Alfalah GHP Value Fund, its top 10 holdings are as follows:

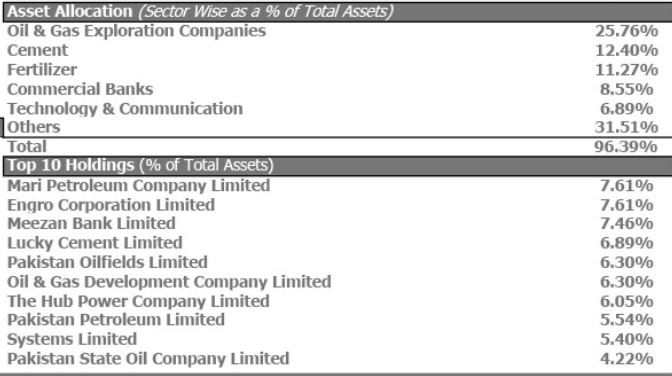

Just with an overview, we can see that its investment in commercial banks makes up for 24.32, the majority of which would be in conventional banks considering that Meezan Bank’s share in the fund’s investments only stands at 2.65%. Therefore, it would be expected that more than 5% of the income of the fund would be Haram and we have not even considered the status of the other stocks in the portfolio yet. On the other hand, if we see its GHP Islamic Stock Funds, we can now see no major investment in conventional banks:

So to conclude, when it comes to mutual funds, it all depends on if the aim of the fund is to be Shariah-compliant, if it is, then well and good otherwise you cannot trust the fund to remain Shariah-compliant even if its initial investments at the time may be as regular buying and selling occurs during the year which can make it hard to keep track of the compliance status. Regardless, make sure you still take a look at the fund manager report and the financial statements of the fund to analyze its activities and the overall prudence of investing in it.